An analyst has explained, using different on-chain indicators, how Uniswap (UNI) could be gearing up for a price breakout.

Uniswap Metrics May Point That A Rally Could Be Brewing Up

In a new post on X, analyst Ali has discussed the outcome that UNI may face based on some underlying metrics. The first indicator of relevance here is the number of addresses carrying their tokens with a net amount of unrealized loss.

Here is a chart that shows the trend in this Uniswap metric over the last few years:

The value of the metric seems to be at significant levels at the moment | Source: @ali_charts on X

From the above graph, it’s visible that around 308,910 Uniswap addresses or investors are underwater right now. This is equivalent to about 87.56% of the cryptocurrency’s entire user base.

Generally, the more investors profit, the higher the chance of a selloff, as holders get tempted to realize their profits. A high amount of holders being in loss, on the other hand, could imply an exhaustion of sellers in the market.

As there is an extreme amount of Uniswap addresses in the red currently, the selling pressure may have already run out. Thus, the asset may be unlikely to decline, at least for now.

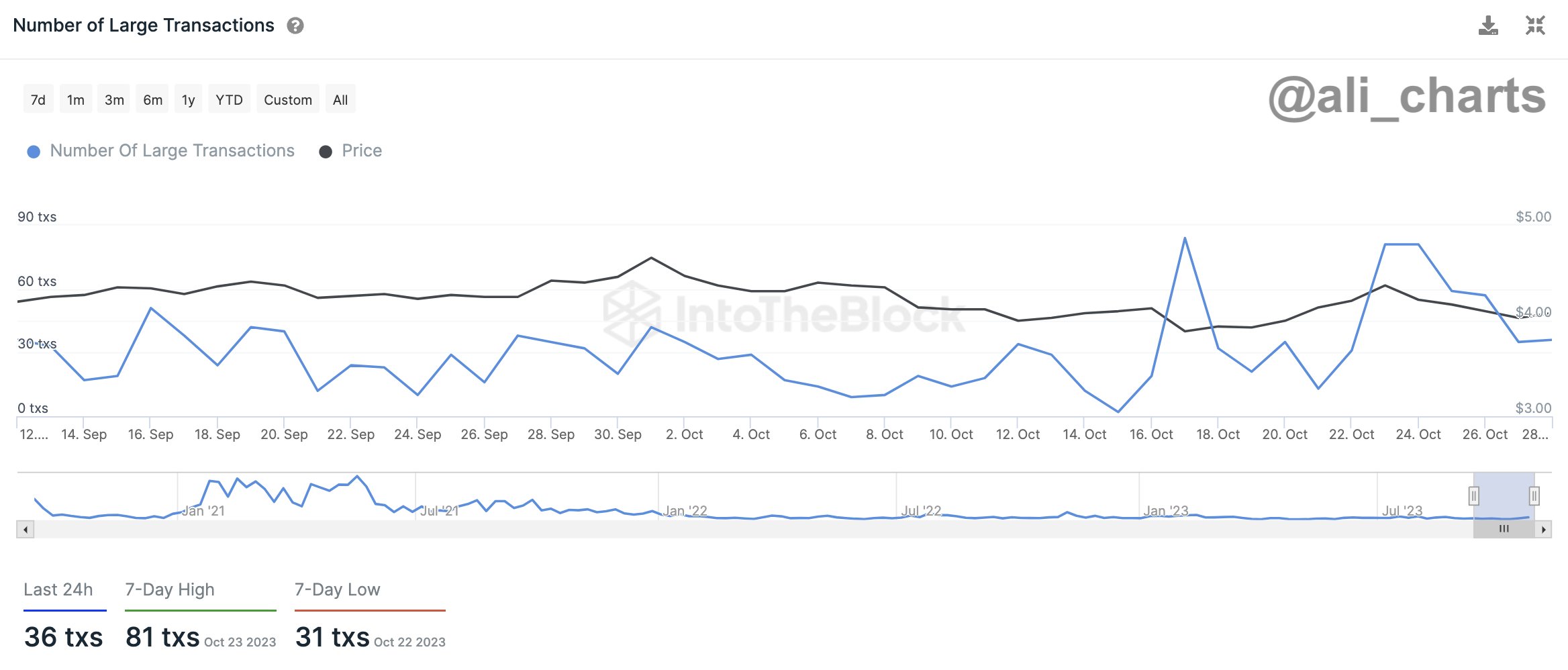

While the market is currently overwhelmingly underwater, Ali notes that the number of large UNI transactions is picking up.

Looks like the value of...